Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal and reduce your surprise medical bill.

- The ER Visit That Started It All

- What Your Insurance Might Not Tell You

- When the Hospital Is Out-of-Network

- The No Surprises Act: Does It Help You?

- What You Can Do If You Receive a Surprise ER Bill

- What If It’s Already Gone to Collections?

- Real Stories, Real Lessons

- What I Learned — and What You Should Do If It Happens to You

- Final Summary: What You Must Know About Surprise ER Bills

The ER Visit That Started It All

A 3AM Emergency and a Deep Cut

It was just after 3AM when she sliced her hand open on a broken glass. It wasn’t just a small cut — it was bleeding heavily, and the edges were jagged. Panicked and in pain, she went to the closest emergency room: AdventHealth, the nearest hospital in her area.

At that moment, no one was thinking about insurance networks. It was about stopping the bleeding and saving her hand.

Wellfleet Insurance: Assumed Safety

At the time, she had active health insurance through Wellfleet. She didn’t think to check whether AdventHealth was in-network. Why would she? It was an emergency. Most people believe that any ER visit would be covered under their plan — at least partially.

She signed the admission papers and got the stitches she needed. End of story… or so she thought.

One Year Later: The Shocking Bill Arrives

Nearly a full year after the ER visit, she received an email: a $1,770 bill from AdventHealth. Confused, she called her insurance provider. That’s when she was told that AdventHealth was out-of-network, and her plan would not cover any of it.

“We thought we were covered. It was an emergency — how can this not be paid for?”

She wasn’t alone in that question. Thousands of people are hit with similar surprise bills every year, long after the panic has passed.

Timeline of the Surprise Bill

| Date | Event | Note |

|---|---|---|

| March 2024 | ER visit at AdventHealth | No verification of network status |

| April 2024 | Insurance paid partial doctor fee | Did not pay hospital facility fee |

| February 2025 | Surprise bill sent: $1,770 | Claim denied due to OON facility |

What Your Insurance Might Not Tell You

In-Network vs. Out-of-Network — What’s the Real Difference?

When it comes to insurance, network status changes everything.

If a hospital is in-network, it means they’ve negotiated lower rates with your insurance provider. You pay less, and your insurance covers more.

If it’s out-of-network (OON), the hospital can charge almost anything — and your insurance may cover none of it.

In emergencies, people often assume they’re protected either way. But that’s not always true.

“It was an emergency. I didn’t have time to check the network.” — Common assumption, costly outcome.

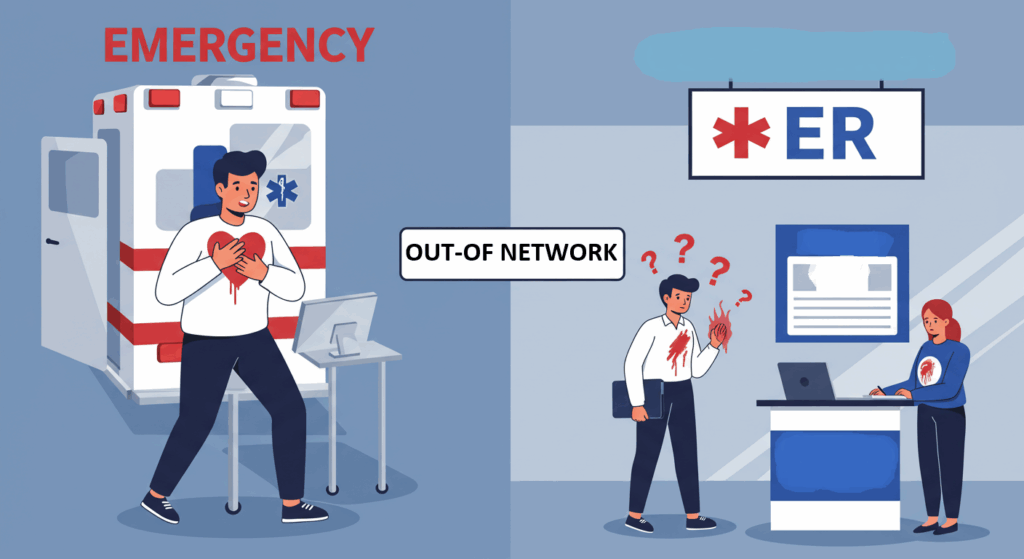

Emergency vs. Urgent: Why It Matters to Your Bill

Even if you’re rushed to the ER, your condition may not be classified as a true emergency.

In the eyes of insurers:

- A heart attack is an emergency.

- A broken arm might be.

- But stitches for a cut? That’s often considered urgent care, and not always covered if OON.

One Reddit user explained that their wife had to jump a median on a highway to get him treated for anaphylaxis — and the insurer still claimed it wasn’t an emergency.

Emergency vs. Urgent Care — Insurance Perspective

| Condition | Likely Category | Coverage (OON) | Example |

|---|---|---|---|

| Chest Pain | Emergency | Covered | Heart attack symptoms |

| Deep Cut Needing Stitches | Urgent | May be denied | Hand laceration at 3AM |

| Severe Allergic Reaction | Emergency | Covered | Anaphylaxis |

| Flu or Fever | Urgent | Likely denied | Urgent care preferred |

When the Hospital Is Out-of-Network

Why Hospitals Don’t Always Tell You

Most patients assume the hospital will inform them if it’s out-of-network. But in reality, hospitals are not required to warn you — especially in emergency situations.

In fact, unless you specifically ask during admission, there may be no mention of network status at all. That means patients often sign treatment agreements without knowing the financial consequences.

“Nobody said it wasn’t covered. I wouldn’t have gone if I knew.”

What “Surprise Billing” Really Means

A surprise medical bill happens when you unknowingly receive treatment from a provider or facility that isn’t in your insurance network — and you get billed for the full amount later.

This is especially common in:

- Emergency rooms

- Radiology and anesthesia services

- Independent contractors working inside hospitals

The worst part? Even if the doctor is in-network, the facility might not be — and that’s what happened in this case.

How to Confirm a Facility’s Network Status

You can try to verify a hospital’s network status in advance by:

- Checking your insurance provider’s online directory

- Calling the hospital billing department

- Using real-time apps like Zocdoc or Healthgrades (for planned visits)

But during an emergency? You rarely have time. That’s why the No Surprises Act was created — but it only helps if your insurance plan complies.

How Surprise Medical Bills Happen

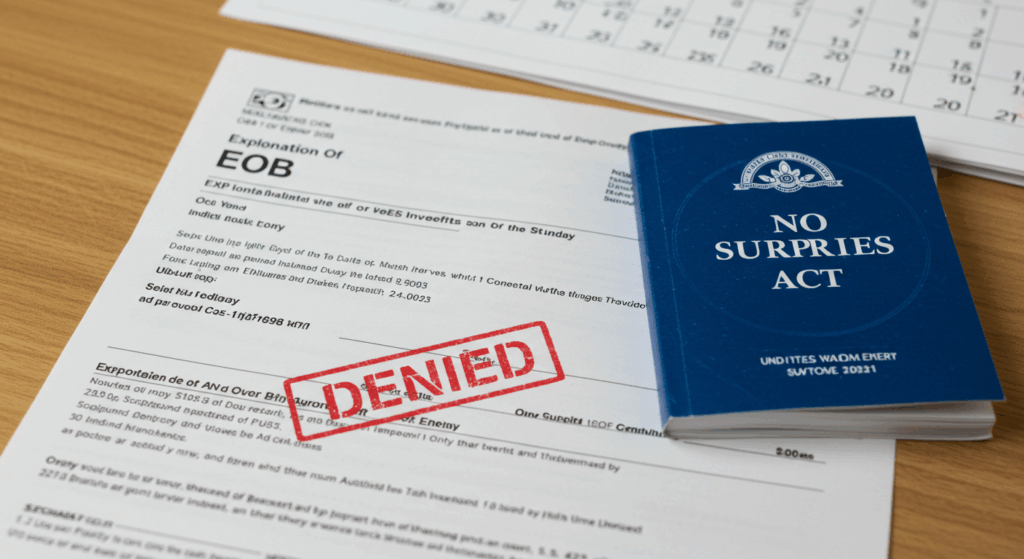

The No Surprises Act: Does It Help You?

What the Law Actually Covers

The No Surprises Act, enacted in January 2022, was designed to protect patients from unexpected medical bills — especially when they receive care from out-of-network providers during emergencies.

Here’s what the law mandates:

- Emergency care at any hospital (including out-of-network) must be treated as in-network for billing.

- Patients are only responsible for the in-network cost-sharing amount (like co-pays or deductibles).

- Balance billing is prohibited in most emergency scenarios.

However, not everyone is protected equally. The law only applies to ACA-compliant private insurance plans, not short-term, fixed indemnity, or certain employer self-funded plans.

Are You Protected If You Have an ACA-Compliant Plan?

If your health insurance is ACA-compliant — like most marketplace, employer, and individual plans — then the No Surprises Act should help in most emergencies.

But if your plan is non-compliant (such as some college plans, travel insurance, or “limited benefit” plans), you may still be vulnerable to full charges from out-of-network providers.

That’s why it’s critical to check your plan type before an emergency ever happens.

Limitations of the Act: What It Doesn’t Cover

The law does not cover every situation. Some common exclusions include:

- Elective or scheduled procedures, even if they take place in a hospital

- Non-emergency out-of-network visits where prior authorization is required

- Ground ambulance services, which are often out-of-network and not protected by the law

- Insurance plans not regulated by federal law, such as some religious-based health ministries

“We assumed the law would protect us — but our plan didn’t even fall under it.”

What the No Surprises Act Covers (and Doesn’t)

| Medical Situation | Covered by No Surprises Act? | Notes |

|---|---|---|

| ER visit at out-of-network hospital | ✔️ Yes | Only with ACA-compliant plan |

| Elective surgery at OON facility | ❌ No | Not emergency — not protected |

| Ground ambulance | ❌ No | Law doesn’t cover this yet |

| Care under short-term insurance | ❌ No | Non-compliant plans not included |

What You Can Do If You Receive a Surprise ER Bill

Step 1: Request an Itemized Bill

Before reacting emotionally to the number, ask the hospital for an itemized bill. This will break down every charge — from the physician’s time to the use of gauze.

You’d be surprised how many “errors” you can find:

- Double billing for supplies

- Charges for procedures not performed

- Facility fees never explained up front

“They charged $349 for a bandage I never saw.”

Step 2: File an Appeal with Your Insurance

Once you’ve reviewed the bill, contact your insurance company and formally appeal the denial. Include:

- The itemized bill

- Your account of the emergency

- Any doctor notes or visit summaries

Ask specifically:

“Can this be re-evaluated under emergency protections or reviewed for internal reconsideration?”

Step 3: Negotiate with the Hospital Billing Office

Hospitals often have billing flexibility, especially if:

- You’re uninsured for that portion

- You offer to pay a reduced amount quickly

- You ask for a financial hardship discount

Use this phrase:

“Is there a prompt pay discount or financial assistance I can apply for?”

Some hospitals offer 20–60% off for direct pay or hardship situations.

Step 4: Consider Filing a Complaint

If your insurer or hospital refuses to budge, file a complaint with:

- Your state insurance commissioner

- The Department of Health and Human Services (HHS) for No Surprises Act violations

- CMS.gov’s No Surprises Help Desk for protected-plan appeals

These agencies may pressure your insurer to reconsider or review systemic abuse.

How to Respond to a Surprise ER Bill

What If It’s Already Gone to Collections?

How Medical Debt Affects Your Credit Score

If you ignored or missed the ER bill long enough, chances are it’s been sent to collections. That’s when your credit score becomes part of the equation.

Until recently, even small unpaid medical debts could tank your FICO score. But after changes in 2022 and 2023:

- Unpaid medical collections under $500 are no longer reported by major credit bureaus.

- Paid medical collections are removed from your credit report.

- Most debts must be at least one year old before they’re reported.

Still, for larger debts like $1,770, you’re not in the clear — especially if they remain unpaid.

What Rights You Have Under the Law

Under the Fair Debt Collection Practices Act (FDCPA) and recent rules from the Consumer Financial Protection Bureau (CFPB):

- Debt collectors can’t harass or mislead you

- You have the right to request debt validation

- You can dispute inaccurate entries on your credit report

- You’re entitled to notice before any reporting occurs

Don’t be afraid to ask for everything in writing and keep a record of every call and letter.

Can You Still Negotiate or Settle at This Point?

Yes — and in many cases, this is the most practical route.

Here’s what you can try:

- Offer a lump sum for partial settlement (e.g., $1,770 → $900)

- Ask for a payment plan with 0% interest

- Get any settlement terms in writing before paying

- Request that they report the debt as “Paid in Full” once resolved

Remember, once it’s in collections, the hospital is no longer in charge — but you still have leverage.

Medical Debt in Collections — What You Should Know

| Topic | Details |

|---|---|

| Reporting threshold | Debts under $500 aren’t reported to credit bureaus |

| Time before reporting | Collectors must wait at least 1 year |

| Rights under FDCPA | Request validation, dispute entries, written notice |

| Negotiation options | Lump sum, payment plan, settle for less |

Real Stories, Real Lessons

“They Said I Still Had an Hour to Find an In-Network Facility”

One user shared their harrowing experience of a life-threatening allergic reaction. Despite being rushed to the ER by his wife — who even jumped a highway median to get him there — the insurance company later denied coverage, saying:

“You still had time to find an in-network facility.”

The ER doctor had told them that one more hour could’ve been fatal.

“I would have died if I waited,” he wrote. “And they told my wife she should’ve checked the network first.”

This story perfectly illustrates how insurers downplay emergencies after the fact.

“My Wife Jumped a Median. They Still Denied It.”

Another reply added nuance to the above case. A second user said the insurer directly questioned his wife, asking:

“Why didn’t you take him to an in-network hospital?”

To which she responded:

“Because his throat was closing and I literally jumped a median to save his life!”

This adds an emotional dimension: not only are patients made to feel like they made a mistake in survival, but caregivers are guilt-tripped too.

“We Thought It Was Covered… Until We Got the Bill.”

This was the most common theme across dozens of comments.

“It was an emergency. We thought we were covered.”

Many assumed that simply going to any ER in an emergency was sufficient. But unless your plan is ACA-compliant and the facility meets federal conditions, you could still owe thousands.

Even for stitches, if it’s not deemed a “true emergency,” coverage may be rejected.

“They called it urgent, not emergent. That’s why they denied it.”

What These Stories Teach Us

| Story | Key Lesson |

|---|---|

| Allergic Reaction Denied | Even near-death cases may be denied if not “emergent” |

| Caregiver Blamed | Caregivers are often unfairly second-guessed |

| Stitches Not Covered | Urgent vs. Emergency distinction can change everything |

What I Learned — and What You Should Do If It Happens to You

The Real Lesson Behind a $1,770 ER Bill

What this experience taught me is simple but unsettling:

You can do everything right and still get burned by the system.

We went to the nearest ER in the middle of the night.

We had insurance.

We trusted that emergencies would be treated fairly.

Instead, we got a bill nearly a year later for $1,770 — and a lesson that “emergency” doesn’t mean what you think it means to insurers.

“Emergency care feels urgent to you. To your insurance, it’s a billing category.”

How to Protect Yourself — Before, During, and After

While no one plans for an emergency, you can prepare for the fallout.

Here’s a simple framework you can apply:

Emergency Insurance Preparedness

| Stage | What You Can Do |

|---|---|

| Before Emergency |

▸ Know if your plan is ACA-compliant ▸ Print a copy of your insurance card ▸ Learn which nearby hospitals are in-network |

| During Emergency |

▸ State that it’s an emergency ▸ Ask if the hospital is in-network (if possible) ▸ Document symptoms and doctor statements |

| After Emergency |

▸ Request an itemized bill ▸ Appeal denials with supporting evidence ▸ Negotiate or apply for financial assistance |

Final Summary: What You Must Know About Surprise ER Bills

Top 5 Key Takeaways

- Not all ER visits are covered by insurance

Even if it feels like an emergency, out-of-network hospitals can leave you fully responsible for the bill. - Wellfleet and similar plans may not qualify for No Surprises Act protection

Only ACA-compliant plans are guaranteed coverage under the law. - “Urgent” vs. “Emergency” isn’t just semantics — it defines what gets paid

A cut that needs stitches might be denied if it’s not “life-threatening.” - Even a bill that arrives a year later can be challenged

You still have the right to appeal, negotiate, and request financial assistance. - Once a bill is in collections, you still have rights

Under federal law, you can validate, negotiate, and even erase medical debts under certain conditions.

What You Should Never Forget

Insurance companies don’t judge emergencies based on your fear — they judge it by billing codes.

✅ Emergency Bill Response Checklist

| Stage | Action Items |

|---|---|

| Before ER | Check if your plan is ACA-compliant. Know in-network hospitals near you. |

| During ER | Document symptoms. Ask about network status if possible. State it’s urgent. |

| After ER | Request itemized bills. File appeals. Negotiate directly with billing office. |

| If in Collections | Request validation. Negotiate. Contact CFPB or your state commissioner. |

I Got a $1,770 ER Bill One Year Later — What You Need to Know About Out-of-Network Charges

Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal…

Why Good Sam RV Insurance Is the Top Choice for RV Owners in America

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage,…

Can You Really Use Home Insurance Claim Money for Something Else?

Wondering if you can use your home insurance claim for a different repair? We break…

What to Do When an Unauthorized Driver Hits You in a Rental Car Accident

Got hit by an unauthorized driver in a rental car and left with unpaid bills?…

I Woke Up With No Memory, Vomiting, and Two Pairs of Underwear — What Happened to Me?

She woke up sick, confused, and with no memory — her clothes were changed, her…

When a Developer Demands You Move Your Mailbox: A Houseowner’s Stand Against Unfair Pressure

A developer told a rural houseowner to move their mailbox to make way for a…