What happens when a customer tricks a dealership into overpaying for a wrecked car? We uncover who really takes the hit—and why this case matters more than you think.

- Introduction

- Vehicle Profile – A Car Built to Deceive

- Bluffing the System – How the Fraud Succeeded

- Inside the Appraisal Process – Where It Failed

- Chain of Consequences – Who Really Pays?

- Insurance & Legal Exposure – Coverage vs. Liability

- A Systemic Vulnerability – Lessons from One Lie

- Final Takeaways – Ethics, Economics, and the Future of Trade-Ins

Introduction

The $9,000 Lie That Worked

In the world of car dealerships, every trade-in is a balancing act. Dealers must determine how much a vehicle is truly worth—often within minutes—while keeping margins, inventory, and customer satisfaction in check. It’s a high-pressure process that relies on fast appraisals, visual cues, and sometimes, a bit of trust.

This is the story of how that trust was exploited.

A customer arrived with a well-presented vehicle. On the surface, it looked fine. No warning lights, clean exterior, working infotainment screen. But behind the polished facade was a car plagued with mechanical failure—collapsed engine mounts, oil leakage, mismatched wheels, and dozens of hidden diagnostic codes that had just been cleared.

They claimed another dealership had offered $11,000 in trade-in value, and that they’d be willing to close the deal here for $9,000. The dealership took the bait.

No physical damage was evident. The appraiser missed the internal issues. The sales manager wanted to close the deal. And just like that, a $9,000 mistake walked off the lot.

But this wasn’t just a one-off incident. This is an example of a much larger problem: how dealership trade-in fraud—even subtle, technically legal forms of it—reveals a structural vulnerability in how vehicles are evaluated, insured, and resold. It’s not just the dealer who gets burned. Often, the financial and physical risks are passed down to others—insurance companies, lenders, and ultimately, future buyers.

In this article, we’ll break down the anatomy of the fraud, trace its ripple effects, and examine how a simple bluff exposed a deep crack in the automotive economy.

Vehicle Profile – A Car Built to Deceive

It wasn’t just a bad car. It was a deliberately curated one.

On paper, the vehicle might have looked decent—mileage under control, no recent accidents on record, reasonably clean title. To the untrained eye, it was a standard trade-in candidate. But the truth lay beneath a carefully polished surface.

Hidden Mechanical Failures

The vehicle had severe internal damage:

- Engine mounts were fully collapsed, causing violent engine movement under load.

- The engine leaked and burned oil so excessively that the driver had to refill it between gas stops.

- The infotainment system would boot briefly, then fail, making it impossible to maintain a Bluetooth or navigation connection.

- Diagnostic Trouble Codes (DTCs) were present by the dozens before being cleared.

A mechanic or advanced diagnostic scan would’ve caught it. But the dealership didn’t go that far.

Visual Deception

From a distance, everything looked clean:

- The wheels had been replaced—but not with OEM parts. Instead, they were pulled from mismatched junkyard vehicles. Cosmetically acceptable, structurally questionable.

- Paint was touched up, light detailing completed. No signs of exterior crash damage.

- No warning lights appeared on the dashboard. All codes were cleared with a basic scanner prior to arrival.

Strategic Manipulation

The customer wasn’t just hiding defects—they were controlling the dealership’s perception:

- By clearing all codes, they created the illusion of mechanical stability.

- By mentioning another offer, they created artificial urgency.

- By presenting a clean car in a high-pressure environment, they framed the appraiser into a quick decision.

The car wasn’t just defective—it was intentionally presented to defeat basic appraisal systems.

And it worked.

Bluffing the System – How the Fraud Succeeded

Every dealership trains its staff to detect deception—but few systems are designed to resist persuasion.

The fraud in this case wasn’t committed through forgery, stolen identities, or hacking. It was done with timing, presentation, and confidence. That’s what makes it so effective—and so dangerous.

The Power of Plausibility

The customer didn’t say anything that could be easily disproven. There was no written proof of the $11,000 offer. Just a confident claim. In an environment where sales managers are trained to “close fast,” the urgency was believable—and hard to ignore.

Salespeople are taught to fear losing a sale.

Even if they suspect bluffing, it’s often safer to match a fictional competitor than to let a customer walk.

Time Pressure as a Weapon

Dealerships operate under tight quotas and shrinking margins. On busy weekends or at month’s end, appraisers must process trade-ins quickly. There’s no time for full diagnostics. When time pressure combines with urgency cues, even seasoned professionals default to shortcuts.

This creates the perfect storm for deception:

- Appraiser sees no obvious damage

- Customer seems reasonable

- Clock is ticking

- Sales manager wants the deal

“Legal Lies” in the Gray Zone

What makes this fraud dangerous is that nothing technically illegal occurred.

- The customer didn’t falsify documents

- The appraiser didn’t skip protocol—they just didn’t see enough red flags

- The dealership agreed voluntarily

But that’s exactly the vulnerability:

Our systems assume honesty until proven otherwise—and in fast sales environments, there’s no time to prove otherwise.

This wasn’t just a scam. It was a psychological hack—and it worked.

Inside the Appraisal Process – Where It Failed

Most consumers think appraisals are comprehensive, mechanical inspections.

They’re not.

At many dealerships, trade-in appraisals are visual, fast, and intuitive. The appraiser often has 5 to 10 minutes to make a decision—less if the store is busy. They’re trained to look for red flags, but when deception is subtle and the schedule tight, mistakes happen.

How Appraisals Typically Work

- Walkaround Inspection

- Look for visible damage, tire wear, cracked glass, mismatched paint

- Often performed in under 2 minutes

- Interior & Dashboard Check

- Start the car, check warning lights, listen for odd sounds

- Scan briefly for infotainment issues, cleanliness

- Quick Drive (Optional)

- Only done if concerns arise or dealership policy allows

- Usually skipped if time-constrained

- KBB/Black Book Valuation + Market Comparison

- Use software or internal systems to check value range

- Adjust based on mileage, make/model demand, condition

- Final Estimate & Manager Review

- Appraiser presents figure to sales or used car manager

- Final value influenced by manager’s desire to close deal

Where It Failed in This Case

- Cleared codes = no dashboard warnings

- Oil leak = undetectable without a lift

- Engine mounts = no test drive, no symptom discovery

- Cosmetic touch-ups = hidden signs of wear

- Urgency narrative = rushed decision

The system wasn’t broken.

It was functioning as designed—for speed, not depth.

And that’s precisely why it failed.

Chain of Consequences – Who Really Pays?

The trade-in is gone. The deal is done. But the financial impact hasn’t disappeared—it’s simply moved downstream.

The car will now begin a journey that transfers risk from one party to another, with each hoping they won’t be the one holding the problem when it finally explodes. This is how hidden damage becomes a system-wide liability.

What Happens to the Car?

There are three common outcomes for problematic trade-ins:

- Wholesale Auction

- The dealership realizes the car has issues after trade-in

- They send it to auction to recover some of the value

- It’s bought by a smaller used car lot or “buy-here-pay-here” operation

- On-the-Lot Resale (As-Is or Light Repairs)

- Minor cosmetic fixes are done

- The car is put back on the dealer lot for resale

- Warranty may or may not apply

- Internal Loss Absorption

- Dealership accepts the loss as cost of doing business

- Loss is written off against profit on new vehicle sale

Who Takes the Hit?

| Stakeholder | Risk Incurred |

|---|---|

| Dealership | Direct financial loss or auction markdown |

| Auction Buyer | Buys vehicle without knowing full condition |

| Subprime Consumer | Buys vehicle on a loan with no warranty, faces mechanical failure soon after |

| Insurance Company | May face higher claim rates if breakdown causes accident |

| Lender | At risk if buyer defaults due to car problems |

The fraudster walks away clean.

Everyone else plays hot potato—with a ticking time bomb.

Risk Distribution After Fraud

| Entity | Impact of Trade-In Fraud |

|---|---|

| Dealership | Loss on trade value, auction markdown, or warranty claim costs |

| Used Car Lot | Receives defective car, risk of return or loss of trust |

| End Consumer | Mechanical failure, unexpected repair costs, possible repossession |

| Insurance Company | Potential accident or breakdown-related claims |

| Lender | Higher default risk on auto loan due to unrepairable vehicle |

Insurance & Legal Exposure – Coverage vs. Liability

The fraudulent trade-in doesn’t just disrupt dealership operations—it introduces invisible liability risks that affect downstream insurance contracts, accident disputes, and even legal accountability.

When Does Insurance Step In?

If the vehicle ends up with a new owner and suffers a mechanical failure or causes an accident, several questions arise:

- Was the condition of the car known at the time of sale?

- Was it sold “as-is” with a signed disclaimer?

- Was there any fraudulent concealment involved?

If the buyer has comprehensive or mechanical breakdown insurance, the insurer might deny claims if the damage is determined to be pre-existing or due to neglect.

If a third party is injured, liability insurance could be triggered—but the blame could stretch back through multiple hands.

Legal Gray Zones and Real Liability

| Scenario | Legal Risk Description |

|---|---|

| Vehicle sold with hidden damage | Civil liability if proven seller knew and misrepresented the condition |

| Insurance claim filed post-failure | Denial likely if failure linked to pre-existing defect |

| Accident caused by mechanical defect | Owner liable, but legal inquiry may uncover dealership responsibility |

| Buyer sues dealership | Outcome depends on proof of knowledge and whether “as-is” clause was signed |

In rare cases, if a pattern of similar trades emerges, a dealership could be investigated for negligence in inspections. Even if they acted in good faith, repeated failures may trigger class-action lawsuits or insurance premium increases.

Legal & Insurance Risks

| Situation | Insurance or Legal Outcome |

|---|---|

| Mechanical failure soon after resale | Claim denied if issue was pre-existing or known |

| Accident caused by vehicle defect | Liability coverage applies, but upstream fault may be litigated |

| Buyer sues dealer for misrepresentation | Depends on documentation and proof of intent |

| Pattern of poor appraisals discovered | Could trigger audit, lawsuit, or insurer penalties |

A Systemic Vulnerability – Lessons from One Lie

This wasn’t just one bad trade.

It was a micro-case that exposed how fragile and assumption-based the used vehicle ecosystem really is.

Every stakeholder involved in that transaction relied on a single, core belief:

“The person before me did their job.”

And when that belief is false, the consequences ripple across the industry.

The Chain of Assumptions

- The sales manager assumed the appraiser caught any major issues

- The appraiser assumed the customer was mostly honest

- The buyer assumed the dealership inspected the car thoroughly

- The insurance provider assumed the vehicle wasn’t pre-damaged

- The lender assumed collateral value was stable

When a single actor in this chain lies, the dominoes fall—and nobody is watching the base.

What This Reveals

- Speed is prioritized over accuracy

Appraisers are under pressure to act fast, not deep. - Verification is superficial

OBD2 scanners, visual checks, and clean interiors can fool most systems. - “As-is” clauses are overused shields

They limit liability but shift risk to unsuspecting consumers. - Lack of forensic traceability

Fraudulent behavior in trade-ins leaves no fingerprints unless the damage resurfaces soon.

How It Can Be Fixed

| Structural Fix | Description |

|---|---|

| Mandatory full diagnostics for trade-ins | Especially when deal value exceeds threshold (e.g. over $5,000) |

| Independent third-party appraisals | For vehicles with uncertain history or unverifiable conditions |

| Delayed final valuation contracts | Allow 48-hour hold after inspection before agreeing on trade value |

| Blockchain-backed vehicle history logs | Immutable logs of condition, not just service visits |

Fraud doesn’t have to be grand or technical.

It only needs to slip through the cracks of trust.

And this case shows how wide those cracks really are.

Final Takeaways – Ethics, Economics, and the Future of Trade-Ins

At first glance, this story might look like a clever win—a consumer outsmarting a big dealership machine.

But beneath the surface, it’s a perfect case study in how misaligned incentives, weak verification systems, and a trust-based market can lead to systemic leakage, reputational risk, and downstream suffering.

The Moral Cost

Lying might win the deal, but it undermines the very trust the market depends on.

Each time deception goes undetected, it reinforces the idea that “cheating works.” That’s corrosive—not just economically, but ethically.

“Markets work when people believe the rules matter.”

If enough people stop believing that, the system collapses into chaos or heavy regulation.

The Economic Ripple

What looks like a single $6,000 mistake by a dealership can become:

- $1,000 in auction markdown

- $2,000 in emergency repairs

- $3,000 loss on resale

- Higher insurance premiums across portfolios

- Lawsuits or state-level dealer scrutiny

The invisible cost of fraud is not just the money lost—it’s the cost to the market’s efficiency.

Where Trade-Ins Are Going

Technology can solve many of these issues, but only if stakeholders act.

| Innovation Area | Future Potential |

|---|---|

| AI-based appraisal tools | Real-time anomaly detection across visual/sound patterns |

| Telemetry + blockchain | Unforgeable driving and maintenance logs |

| Centralized dealer databases | Fraud pattern detection across multiple locations |

| Regulation of “as-is” sales | Minimum diagnostic standards for all trade-ins |

Final Thought

What started as a lie for $6,000 off a car

ended up revealing a $60 billion blind spot in an industry.

This wasn’t just a story.

It was a mirror.

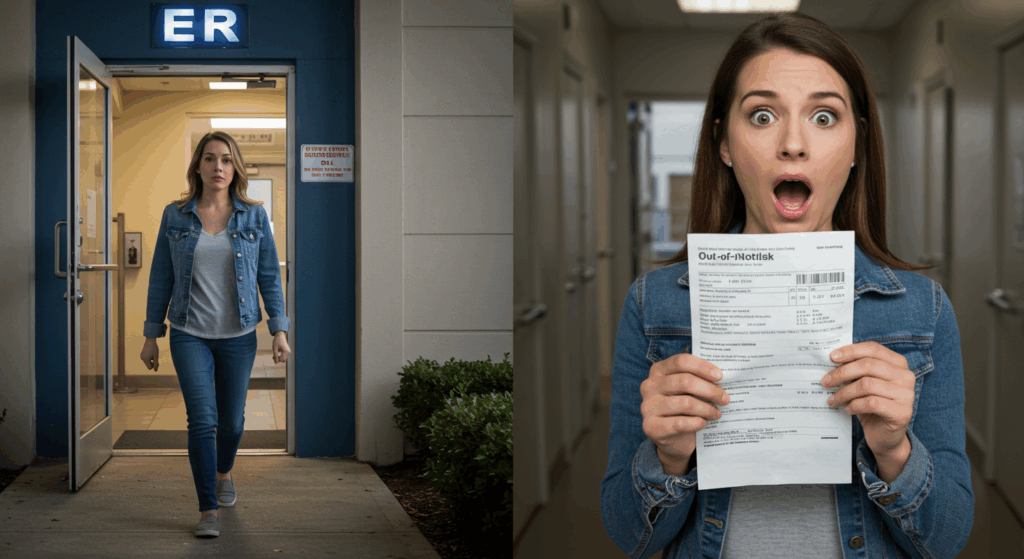

I Got a $1,770 ER Bill One Year Later — What You Need to Know About Out-of-Network Charges

Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal…

Why Good Sam RV Insurance Is the Top Choice for RV Owners in America

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage,…

Can You Really Use Home Insurance Claim Money for Something Else?

Wondering if you can use your home insurance claim for a different repair? We break…

What to Do When an Unauthorized Driver Hits You in a Rental Car Accident

Got hit by an unauthorized driver in a rental car and left with unpaid bills?…

I Woke Up With No Memory, Vomiting, and Two Pairs of Underwear — What Happened to Me?

She woke up sick, confused, and with no memory — her clothes were changed, her…

When a Developer Demands You Move Your Mailbox: A Houseowner’s Stand Against Unfair Pressure

A developer told a rural houseowner to move their mailbox to make way for a…