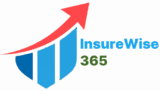

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage, and unbeatable roadside assistance.

- 1. When Your RV Is Your Home, Insurance Isn’t Optional

- 2. What Good Sam Covers That Others Don’t

- 3. Full-Timer vs Part-Timer — You’re Covered Either Way

- 4. Roadside Assistance: When You’re Truly in the Middle of Nowhere

- 5. Real RVers, Real Reviews

- 6. What Good Sam Costs — And Why It’s Worth It

- 7. Who Should Choose Good Sam (and Who Shouldn’t)

- 8. Final Thoughts: RV Life Deserves Better Insurance

1. When Your RV Is Your Home, Insurance Isn’t Optional

“A blown tire in the desert. A fire on the freeway. A break-in while you’re hiking miles away. These aren’t rare for RVers — they’re just part of the journey.”

For thousands of RV owners across the U.S., their vehicle is more than a weekend toy — it’s a living space, a travel hub, and in many cases, a permanent home. With that kind of investment, both emotional and financial, the right insurance is not a luxury. It’s essential.

RV life is full of freedom, but that freedom comes with risk.

Unlike a car, an RV holds more than just passengers. It holds memories, belongings, and sometimes even your entire life. One bad day — a rollover, a wildfire, a hailstorm — and you could lose everything.

What happens if your RV is totaled while you’re traveling across Utah?

What if someone breaks in and steals your solar equipment while you’re exploring Yosemite?

If your insurance only covers the depreciated value of your vehicle, you may find yourself stuck — with no ride, no gear, and no financial backup.

This is exactly why RV-specific insurance is different from regular auto insurance. It’s designed to cover those real, specific, high-stakes situations that RV owners face every single day.

“Standard car insurance doesn’t cut it when your vehicle is your home.”

2. What Good Sam Covers That Others Don’t

“You don’t just need more coverage — you need the right kind.”

Most insurance companies offer RV protection as an afterthought — a tiny add-on to their standard auto policy. But RV life brings unique risks that a car policy simply doesn’t address.

Let’s take a closer look at what makes Good Sam RV Insurance so different.

Key Coverage Differences

| Feature | Good Sam RV Insurance | Typical Auto Insurance |

|---|---|---|

| Total Loss Replacement | ✔️ Included (up to 5 years) | ❌ Actual Cash Value only |

| Full-Timer Liability | ✔️ Up to $500,000 | ❌ Not available |

| Personal Effects Protection | ✔️ Covers belongings inside RV | ❌ Limited or excluded |

| Emergency Expense Allowance | ✔️ Covers hotel, travel costs | ❌ Not included |

| Pet Injury Coverage | ✔️ Yes, even vet bills | ❌ Rare or unavailable |

| Optional Storage Mode | ✔️ Reduced premium during storage | ❌ No discount while unused |

“You’re not insuring a car. You’re insuring a way of life.”

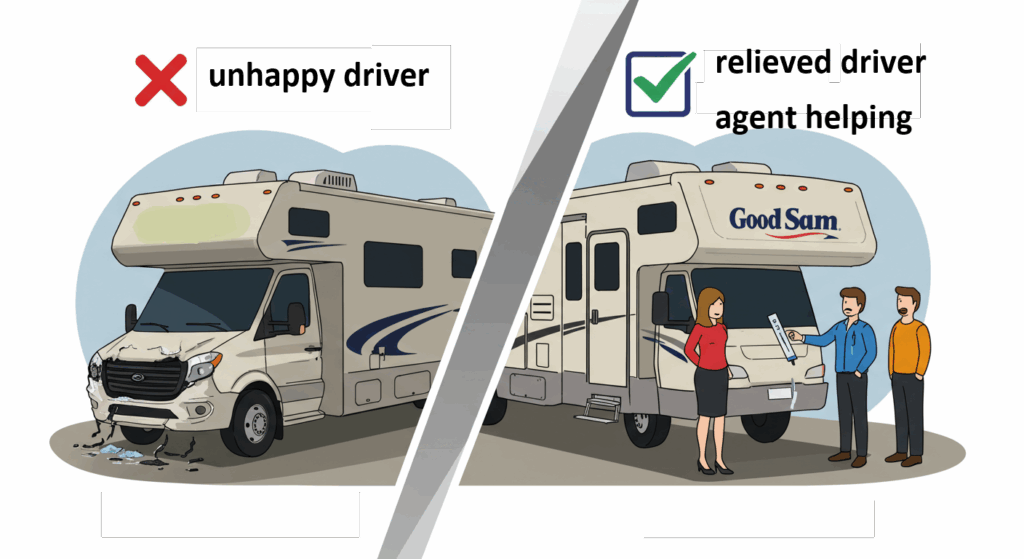

General Auto Insurance vs Good Sam

Depreciated value only, no coverage for personal items, limited roadside help

Total Loss Replacement, Full-Timer Coverage, Pet Injury Protection

Real user quote

“I had no idea my auto policy wouldn’t cover my stuff inside the RV until I filed a claim. Switched to Good Sam the next week.”

— Tom, full-time RVer from Colorado

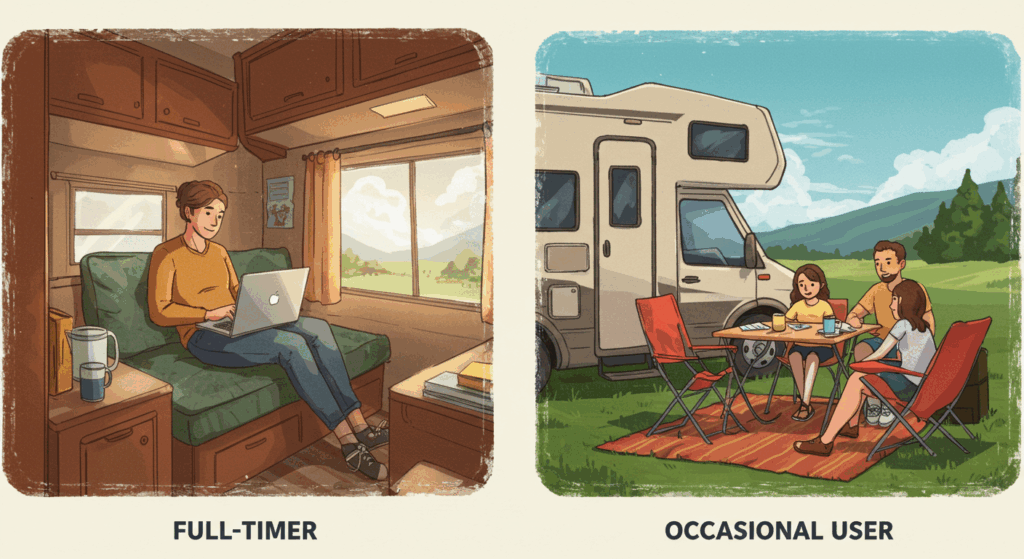

3. Full-Timer vs Part-Timer — You’re Covered Either Way

“You don’t have to explain your RV lifestyle to us. We’ve already built coverage for it.”

Not all RV owners use their vehicles the same way. Some live in them year-round, others take them out just a few times a year. But no matter how you roll, Good Sam RV Insurance adjusts to your lifestyle.

For Full-Time RVers:

If your RV is your primary residence, Good Sam offers Full-Timer Liability Coverage — which works like homeowners insurance.

- Covers personal liability if someone gets injured near or inside your RV

- Includes medical payments to others

- Offers up to $500,000 in liability protection

- Recognizes your RV as your legal home

“Living full-time in an RV means your risks look like a homeowner’s, not a driver’s — and Good Sam gets that.”

For Part-Time Travelers:

If you’re only using your RV for vacations, weekends, or seasonal trips, you don’t need full-timer benefits — but you still get exceptional protection.

- Standard RV collision and comprehensive coverage

- Personal belongings protection during trips

- Optional “Storage Mode” discount when RV is parked

- Emergency expense coverage during breakdowns away from home

No matter your lifestyle, the insurance isn’t one-size-fits-all — and with Good Sam, it doesn’t have to be.

Full-Time vs Part-Time Coverage

| Coverage Feature | Full-Time RVer | Part-Time RVer |

|---|---|---|

| Liability Protection (up to $500k) | ✔️ | ❌ |

| Personal Effects Coverage | ✔️ | ✔️ |

| Storage Mode Discount | ❌ | ✔️ |

| Emergency Expense Coverage | ✔️ | ✔️ |

4. Roadside Assistance: When You’re Truly in the Middle of Nowhere

“Flat tire. Dead battery. Locked keys. Now imagine all that — 200 miles from the nearest town.”

When you drive a motorhome or tow a fifth wheel, breakdowns aren’t just inconvenient — they’re potentially dangerous. RVs are heavy, wide, and often in places far from cities or even cell reception.

That’s why Good Sam offers 24/7 roadside assistance, with a network that understands RVs aren’t just big cars.

With certain plans, you get:

- Unlimited towing distance to the nearest repair center

- Flat tire repair and replacement

- Battery jumpstarts and fuel delivery

- Locksmith services if you’re locked out

- RV-specific mechanics who know motorhomes and trailers

Most importantly, you won’t be left explaining to a generic towing company how to handle a 35-foot Class A.

“We’ve had breakdowns in the Rockies, in the Texas panhandle, and even in Maine. Every time, Good Sam got someone out there — fast.”

Even if your RV is fine, many plans also cover your tow vehicle or rental car, so your trip doesn’t have to end just because your engine did.

5. Real RVers, Real Reviews

“Everyone talks about peace of mind — this is the first time I’ve actually felt it.”

What do RVers really say about Good Sam?

Across forums like iRV2, Reddit’s r/GoRVing, and RV.net, one name keeps coming up when people ask for insurance recommendations — and not just because it’s popular.

Many full-timers and seasoned RV travelers praise Good Sam for:

- Fast, professional roadside help

- Clear claims process with minimal friction

- Fair handling of personal property claims

- Specialized support staff who know RV needs

“Filed a claim on Monday. Adjuster called me Tuesday. Check came Friday. Never had that kind of turnaround with GEICO.”

Even in situations where a claim wasn’t approved, reviewers often say the reps were upfront and respectful — something that’s rare in insurance.

“They actually explained why it was denied, didn’t just ghost me. That alone puts them above others I’ve dealt with.”

The trust comes not just from advertising, but from what long-haul users say after real emergencies.

6. What Good Sam Costs — And Why It’s Worth It

“You can find cheaper insurance. But what happens when it actually matters?”

On average, Good Sam RV Insurance costs more than a standard auto policy with RV coverage added — but that’s not an apples-to-apples comparison.

Here’s why the price is justified:

- Total Loss Replacement isn’t standard — it’s premium

- Full-timer liability is essentially homeowner’s insurance

- Roadside assistance isn’t limited by mileage or service type

- Personal effects coverage goes far beyond what most auto insurers offer

“Yeah, I pay more than I did with Progressive — but I actually got my stuff replaced. That’s what I paid for.”

Typical Annual Premiums

| RV Type | Basic Auto Insurer (Add-On) | Good Sam (Full Coverage) |

|---|---|---|

| Travel Trailer | $300–$500 | $500–$900 |

| Fifth Wheel | $400–$700 | $650–$1,200 |

| Class C Motorhome | $500–$800 | $900–$1,600 |

| Class A Motorhome | $700–$1,200 | $1,200–$2,200 |

These are averages. Actual cost varies based on driving record, RV value, location, and full/part-time use.

In other words, you’re paying for what happens on the worst day of your trip — not just for the paper proof of coverage.

If that day comes, Good Sam proves its worth.

7. Who Should Choose Good Sam (and Who Shouldn’t)

“It’s not for everyone — and that’s actually a good thing.”

Good Sam RV Insurance offers premium-level protection — but it’s not always the right fit for every RVer.

Here’s who should absolutely consider it:

- Full-time RVers who live in their vehicle year-round

- Owners of Class A or high-value motorhomes

- Travelers who often go off-grid or far from service areas

- People who carry expensive gear, pets, or personal items

“If your RV is your home, not just your weekend plan — you need more than basic coverage.”

But it might not be necessary if:

- You rent RVs for short trips and don’t own one

- Your RV is covered through a bundled auto/home policy

- You’re only using it seasonally and store it most of the year

- Your RV’s value is low and repair costs aren’t a concern

Decision Flowchart

✅ You need Full-Timer coverage

➡️ Is your RV worth over $75,000?

Whether it’s for peace of mind, financial protection, or both — if you rely on your RV for more than a vacation, Good Sam is worth it.

8. Final Thoughts: RV Life Deserves Better Insurance

“Your RV isn’t just something you drive. It’s something you live in, something you trust, something you love.”

RV life isn’t always glamorous. It’s flat tires in the rain. It’s surprise repairs in strange towns. It’s the vulnerability of being far from home — and choosing that anyway.

That’s why your insurance shouldn’t treat your RV like a car.

Good Sam RV Insurance reflects the reality of how RVers actually live.

Not just what they drive, but how they move, where they go, and what they carry.

When you’re miles from a mechanic and your entire trip is on the line,

that’s not the time to wonder what your policy says.

That’s the time to be glad you chose the one that gets it.

Because RV life deserves better than basic coverage.

I Got a $1,770 ER Bill One Year Later — What You Need to Know About Out-of-Network Charges

Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal…

Why Good Sam RV Insurance Is the Top Choice for RV Owners in America

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage,…

Can You Really Use Home Insurance Claim Money for Something Else?

Wondering if you can use your home insurance claim for a different repair? We break…

What to Do When an Unauthorized Driver Hits You in a Rental Car Accident

Got hit by an unauthorized driver in a rental car and left with unpaid bills?…

I Woke Up With No Memory, Vomiting, and Two Pairs of Underwear — What Happened to Me?

She woke up sick, confused, and with no memory — her clothes were changed, her…

When a Developer Demands You Move Your Mailbox: A Houseowner’s Stand Against Unfair Pressure

A developer told a rural houseowner to move their mailbox to make way for a…