Wondering if you can use your home insurance claim for a different repair? We break down Reddit advice, real policies, and a federal ruling.

- When Your Insurance Check Feels Like Free Money — But Isn’t

- What Reddit Users Are Saying — Real Advice from the Ground

- The Hidden Rule: What Is Recoverable Depreciation?

- What Happens If You Don't Replace the Claimed Item?

- The Court’s Perspective: Farmers v. Subscribers Case

- How to Decide Before Spending Your Claim Money

- ✅ Step 1: Re-Read the Declaration Page of Your Policy

- ✅ Step 2: Talk to Your Insurance Adjuster — In Writing

- ✅ Step 3: Review Mortgage Lender Requirements (If Co-Endorsed)

- ✅ Step 4: Document Everything Before You Spend a Penny

- Insurance Tip: Want More Freedom? Get the Right Riders

- Summary Checklist Before You Spend

- What Insurance Companies Don’t Always Tell You

- Final Takeaways — Before You Cash That Check

- Summary: Can You Use Home Insurance Claim Money Differently?

When Your Insurance Check Feels Like Free Money — But Isn’t

“We decided gutter guards are just not worth it… so we wanted to use the insurance money to replace the gutters instead. Is that allowed?”

It’s a common feeling: You file a home insurance claim, the check arrives, and suddenly you’re staring at a chunk of money that feels, well, a little bit like a windfall. After all, your house was damaged, the insurance company agreed to cover it, and now you’re holding a check. So… do you really have to spend that money fixing the exact thing you claimed?

This very question sparked a wave of discussion on Reddit. A homeowner from Minnesota with a State Farm homeowners policy shared their experience after receiving a payout for hail damage. The insurance had covered the replacement cost of gutter guards, minus depreciation. But after some back-and-forth with contractors, the homeowner realized something unexpected:

“These gutter guards are causing more trouble than they solve. Pine needles, wasps… It’s just more maintenance.”

Instead of replacing the damaged gutter guards, they wanted to use the money to install entirely new gutters — a component that wasn’t even listed in the original claim. That raises a real-world question many homeowners never consider until it’s too late:

Can you legally or practically use your insurance payout for something different than the damaged item?

The Emotional Dilemma

It’s not just about maximizing the check — it’s about making a smarter repair choice. But once that choice diverges from what your policy originally covered, things can get messy. The Reddit user had already cashed the first check (endorsed by their mortgage lender), but before cashing in on the rest, they hesitated:

“Am I putting that second payment at risk by not replacing the gutter guards?”

And that’s the right question to ask. Because while the first payment often reflects the ACV (Actual Cash Value), the second payment — the part held back — only comes if you prove that you actually completed the intended repair.

What’s at Stake?

At first glance, spending the money elsewhere may not seem like a big deal. You’re still improving your home. In fact, your decision might be more functional or aesthetically pleasing than what the insurer originally valued. But here’s the issue:

- You may forfeit the remaining Recoverable Depreciation.

- Your mortgage company may object to spending outside of the approved scope.

- Your insurer may require documentation showing like-for-like replacement.

This is where Reddit wisdom, real-life insurance experiences, and even federal court rulings start to converge — and why you should tread carefully before using your claim money in a “smarter” way.

What Reddit Users Are Saying — Real Advice from the Ground

Reddit isn’t always the place for legal expertise, but when it comes to real-life insurance experiences, few places are more honest. That’s exactly what happened when one Redditor asked:

“State Farm paid out for our gutter guards, but now we want to replace the gutters instead. Are we allowed to do that?”

The question opened the floodgates — and brought in some sharp, practical answers from people who’ve dealt with similar situations or work in related industries. Let’s break them down.

“You Can Spend It — But Don’t Expect the Rest”

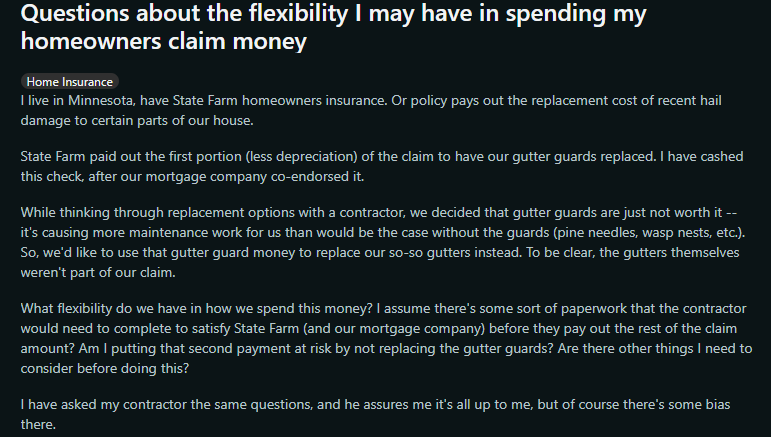

One of the most upvoted comments came from a user who gave it straight:

“You can spend it on whatever you want, but you will not be able to claim the recoverable depreciation.”

— u/Head-Tailor-1728

In other words, yes — the check is technically yours. But unless you replace exactly what was damaged (in this case, the gutter guards), you’re not entitled to the second part of the payment — the portion held back as recoverable depreciation.

What’s Recoverable Depreciation, Again?

When your insurance policy pays out, you typically receive two parts:

- ACV (Actual Cash Value):

The initial check you get — it’s the value of the damaged item minus depreciation. - RCV (Replacement Cost Value):

What it would cost to fully replace the item today. The difference is paid later — if and only if you prove you actually replaced it.

That held-back difference? That’s the recoverable depreciation.

Real Example from Reddit

Another commenter, u/brycas, offered an easy-to-understand breakdown:

“If you had an ACV of $7 and $3 held back in depreciation (RCV total = $10), you’d only get the full $10 if you spent $10. If you only spent $6, you get nothing extra. Spend $8? You might get $1.”

Let’s look at that in a simple table:

| Amount Spent | Recoverable Depreciation Paid | Total Received | Result |

|---|---|---|---|

| $6 | $0 | $6 | No extra payout |

| $8 | $1 | $9 | Partial depreciation reimbursed |

| $10 | $3 | $10 | Full RCV paid |

Reddit Takeaway: It’s Your Money — But Only the First Half

You might feel tempted to use the money differently. Reddit says: you can — but know the consequences. If you’re okay not getting the depreciation, go ahead. If not, you’ll need documentation proving the exact item was replaced.

Insurance Tip: What Coverage Would Help Here?

This is where Extended Replacement Cost coverage or a Cash-Out Option Endorsement comes into play.

- Extended Replacement Cost allows for some leeway when you replace items with functionally equivalent alternatives.

- Cash-Out Endorsements let you take the money even if you don’t plan to replace the damaged item — perfect for when you decide not to rebuild, but reinvest elsewhere.

Before you file the claim, ask your insurer:

“If I choose not to replace the exact item, will I still be eligible for full reimbursement under my current policy?”

Some policies will say no — others (especially higher-tier ones) may allow it.

The Hidden Rule: What Is Recoverable Depreciation?

Most homeowners don’t realize there’s a “second check” waiting for them — and that it’s conditional. This second check is called Recoverable Depreciation, and it’s one of the most misunderstood parts of a replacement cost insurance policy.

Recoverable depreciation isn’t a trick. It’s a structured delay that helps insurance companies avoid overpaying if the repair or replacement never actually happens.

Why Do Insurance Companies Do This?

Let’s say your policy promises “Replacement Cost Value” (RCV). That means the insurer will pay you the full cost of replacing the item — but not all at once.

You first receive the Actual Cash Value (ACV) — that’s the value of the damaged item today, accounting for depreciation.

The rest — the recoverable depreciation — is paid only after you prove that you spent the money to actually replace or repair the damaged item.

How the Two-Payment System Works

Let’s break it down in a typical example:

- You file a claim for damaged siding. The insurance company says it costs $10,000 to replace.

- They pay you $7,000 first (ACV).

- You must submit a contractor invoice proving you spent the full $10,000.

- Then you get the final $3,000 (recoverable depreciation).

🧩 Let’s visualize it:

Why It Catches People Off Guard

This structure creates the illusion that you can spend the check however you want. After all, it’s already in your bank account. But if you spend that money on something else — even another home upgrade — you risk losing the rest.

“It’s your money — but only partially, until you show proof.”

Insurance Tip: What Policy Add-Ons Help With This?

- Guaranteed Replacement Cost:

This pays the full amount regardless of actual spending (rare, but valuable). - Cash-Out Option (No Repair Required):

Allows you to take ACV only — no second payment, but also no strings.

Ask your insurer if your policy includes:

“Is recoverable depreciation conditional? Do I need to match the exact item to receive it?”

What Happens If You Don’t Replace the Claimed Item?

You’ve received the check. You’ve decided not to replace the exact item listed in the claim. Maybe you think a different fix is more logical. Or maybe you’re just too busy.

But here’s the hard truth: Not replacing what was claimed can affect your remaining payout, your relationship with your mortgage company, and even your future insurance renewal.

Insurance Companies Can Request Proof

Insurance companies aren’t naïve. They don’t issue that second check blindly.

If you want to receive recoverable depreciation, most insurers — including State Farm — require that you submit proof of like-for-like replacement.

🧾 Examples of accepted proof:

- Contractor receipts

- “Paid in full” invoices

- Final photos of completed work

If you submit proof showing you replaced the damaged gutter guards with brand-new gutters, the insurer may reject the second payment — because you didn’t replace the exact thing they valued.

What About Cheaper Replacements?

Reddit user ExPatBadger asked a smart follow-up:

“If we opted for a cheaper version of the gutter guard, would State Farm re-calculate the RCV and adjust the second payment?”

The answer, according to other Redditors? Maybe — but not always.

Insurance companies may:

- Adjust the payout to reflect the lower-cost item

- Deny the recoverable depreciation if the replacement isn’t functionally equivalent

- Ask for detailed documentation that shows “like-kind and quality” repair

So even if you “technically” replace something, if it’s not equivalent in cost or function, you might not qualify for the rest of the money.

Your Mortgage Lender Might Also Object

If your claim check was co-endorsed by your mortgage lender — as is common — they can restrict how the money is spent.

They usually want to see the property restored to its insurable value — and changing the scope of repairs may trigger their internal review or hold-up additional payouts.

“The bank’s name is on the check for a reason — they want to protect their asset.”

This often means you’ll need to:

- Send copies of the contractor contract

- Let a loan servicer inspect the repairs

- Wait weeks or months for the lender to release funds held in escrow

Insurance Tip: What Can Help in This Situation?

Look for policies with these riders:

- Loss Payee Waiver Clause

Lets you manage repairs without requiring the mortgage company’s full co-control. - Flexible Repair Documentation Rider

Accepts broader forms of documentation to release depreciation.

These riders aren’t always included by default — but many insurers offer them on request or for an added premium.

Bottom Line

You can’t just cash the check and change the plan without consequences. Whether it’s the insurer or your bank, someone will likely want proof that the repair was done properly — and done right.

If you don’t provide that?

✔️ You may lose the rest of the payout

✔️ Your policy might not renew

✔️ Your mortgage lender may restrict future claims

In the next section, we’ll explore what federal court judges have said about these responsibilities — and how they affect homeowners like you.

The Court’s Perspective: Farmers v. Subscribers Case

Can an insurance company decide how you use your claim money?

Or more importantly — do they have the legal right to withhold funds unless you repair the exact item they approved?

To answer that, let’s look at a major 2023 case: Paul Lim et al. v. Farmers Group, Inc., heard in the U.S. District Court for the Central District of California.

Case Summary

This class-action lawsuit wasn’t about hail damage or gutters.

It was about something deeper: how insurance companies manage money they collect from policyholders — and whether they act in the customers’ best interest.

In this case, policyholders (called “subscribers”) sued Farmers Group and its affiliates for:

- Taking excessive management fees

- Failing to return surplus premium funds to policyholders

- Acting in favor of their parent company instead of the customers

The Legal Question

Do insurers — especially when acting as attorneys-in-fact — owe a fiduciary duty to their policyholders?

The answer from the court: Yes. Absolutely.

“The attorney-in-fact’s relationship with each subscriber is that of a fiduciary.”

— Court Order, Nov 13, 2023

This means insurance managers must act with loyalty, transparency, and in the financial best interest of the insured — not their own bottom line.

Why This Matters to You

When an insurer refuses to release the rest of your claim money unless you replace the exact damaged item, they’re exercising what they view as fiduciary responsibility — to control disbursement, avoid fraud, and maintain policyholder equity.

In the Farmers case, the court sided with subscribers because the insurer allegedly used policyholder money for corporate gain rather than fulfilling their duty to their clients.

Just like in your case:

- If the insurer withholds depreciation

- Or limits how funds can be spent

- They must be acting in your interest — not theirs

Insurance Tip: How to Protect Yourself Legally

- Review your policy’s fiduciary language: Does it define how and when funds can be withheld?

- Request a payout breakdown in writing from your adjuster

- If your insurer is not acting transparently, consult:

- A public adjuster

- A property insurance attorney (especially if over $10,000 involved)

Legal Takeaway

“When an insurance company holds back your money, it’s not just about policy — it’s about trust and legal duty.”

— Interpretation from Farmers case

While every policy varies, the legal principle is clear:

Insurers must treat your money with care, disclose their methods, and avoid acting against your financial interest.

How to Decide Before Spending Your Claim Money

You’ve got the check. You’ve got a better idea.

Now here’s the hard part: deciding what to do — without making a costly mistake.

Before you swap your repair plan or skip the replacement altogether, walk through this checklist.

These decisions are small, but the consequences can be big.

✅ Step 1: Re-Read the Declaration Page of Your Policy

This is where the details hide.

Look for these key terms:

- “Replacement cost coverage”

- “Recoverable depreciation”

- “Like-kind and quality”

- “Functional equivalency clauses”

If your policy is Actual Cash Value only, you’ll get one payment and that’s it.

But if it’s RCV, the fine print tells you what you need to do to get the rest.

✅ Step 2: Talk to Your Insurance Adjuster — In Writing

Don’t assume. Ask them:

“If I decide to replace the damaged item with a different product or upgrade, will I still be eligible for the full depreciation reimbursement?”

Get the response in writing via email.

This way, if anything gets disputed later, you have a paper trail.

✅ Step 3: Review Mortgage Lender Requirements (If Co-Endorsed)

If your mortgage company’s name is on the check, that means you are not fully in control of how that money is used.

Call your servicer or check your mortgage agreement:

- Do they require same-item repair?

- Will they inspect the repairs before releasing escrow funds?

- Can they withhold payment if the scope of work changes?

Mortgage companies are known to delay or deny check endorsement if your repair deviates from the claim.

✅ Step 4: Document Everything Before You Spend a Penny

Before replacing anything, do this:

- Photograph the damaged item

- Get multiple repair quotes

- Save the original claim report

- Record phone calls or take notes on every interaction

If you end up in a dispute, this paper trail can be the difference between full reimbursement and a lost claim.

Insurance Tip: Want More Freedom? Get the Right Riders

If you want to avoid all this paperwork and still have flexibility, consider policies that include:

- Pre-approval Flexibility Clause:

Allows approved substitutes or upgrades without impacting depreciation reimbursement. - Contractor-Managed Escrow Option:

Gives the contractor control of repairs and payment flow, reducing delays from the mortgage company.

You can request these at the time of policy purchase or renewal — or in some cases, as a paid endorsement after a claim.

Summary Checklist Before You Spend

- [ ] Check if your policy is RCV or ACV

- [ ] Ask your insurer in writing about replacement flexibility

- [ ] Get mortgage rules if lender is on the check

- [ ] Save all receipts, photos, and documents

- [ ] Consider upgrading your coverage at renewal time

What Insurance Companies Don’t Always Tell You

“Not sure why I’ve struggled to understand State Farm’s documents — I swear I’m not an idiot.”

— Reddit user, ExPatBadger

You’re not alone.

Many homeowners are left scratching their heads after reading their policy documents. And that’s not by accident.

The truth is: Insurance policies are often written to confuse, not clarify.

And when it comes to recoverable depreciation and replacement requirements, ambiguity works in the insurer’s favor.

Why Are the Documents So Vague?

There are two main reasons:

- Legal Flexibility

Insurers want wording that gives them options. The more ambiguous the policy, the easier it is to interpret terms differently depending on the claim. - Claims Filtering

Many people don’t challenge denials because the documents make them feel like they’re wrong — even when they’re not.

Vague language helps insurers reduce how many people pursue full payout.

The Fine Print Trick

Let’s look at typical ambiguous language you’ll find:

“We will reimburse the replacement cost, provided the item is replaced with like-kind and quality and receipts are submitted within a reasonable time frame.”

Nowhere does it define:

- What “like-kind and quality” really means

- How long “reasonable time” is

- Whether upgrades or downgrades are acceptable

- What constitutes valid “proof of replacement”

This is by design — so that the adjuster can interpret the clause narrowly when convenient.

How You Can Fight the Ambiguity

- Ask Specific Questions

- “If I replace my item with a similar but not identical one, will I still receive full RCV?”

- “What documentation will you require, specifically?”

- Request Definitions in Writing

If a term like “reasonable time” or “like-kind” is used, ask your adjuster to define it.

Make them put it on record. - Use a Public Adjuster

These licensed professionals work for you, not the insurance company.

They know the tricks — and how to push back.

Insurance Tip: Upgrade to Policies That Prioritize Clarity

Not all insurers play these games. Some carriers offer:

- Plain Language Endorsements:

Riders that override legalese with clear, defined terms. - Transparent Claims Process Add-ons:

Access to real-time claim tracking, clear payout rules, and dispute resolution options.

When renewing, ask:

“Is there an option for a ‘Plain Language Policy’ or clarity rider?”

Some high-end homeowners policies offer this as a built-in feature.

Final Thought for This Section

If you’re confused, frustrated, or unsure whether you’re “doing it right” —

That’s not your failure. That’s how the system is designed.

In the next section, we’ll tie all of this together and walk through a real-world decision, highlighting what to do, what to document, and what to ask before you deposit or spend that insurance check.

Final Takeaways — Before You Cash That Check

By now, you understand that a home insurance check isn’t a blank check — it’s a conditional agreement.

And using that money differently, even with good intentions, can lead to delays, denials, and financial loss.

Here’s what you need to remember before you sign, spend, or settle.

1. Know Which Half of the Money You Got

Initial check = Actual Cash Value (ACV)

Second check = Recoverable Depreciation

You only get the second part if you can prove replacement of the same or equivalent item.

Spending the ACV check is easy — but getting the rest depends on evidence.

2. Replacing With Something Else? Proceed Carefully.

- You might lose the rest of the payout

- Your insurer could recalculate the claim

- You may be asked to return funds if changes violate the policy

Before doing anything different, ask your adjuster:

“Will this alternate repair still qualify for the full claim reimbursement?”

3. If a Mortgage Company Is Involved, Expect Restrictions

If your lender co-endorsed the check:

- They may require inspections

- They can delay release of funds

- They may deny changes to the repair scope

Always notify your loan servicer before making major adjustments.

4. Keep Proof — Even for the Obvious Stuff

You’ll need to document:

- What was damaged

- What you replaced it with

- How much it cost

- Who did the work

- When it was completed

Even if it seems “obvious,” no proof = no money when it comes to recoverable depreciation.

5. The Smartest Policy Is One That Gives You Options

You can avoid future headaches by choosing insurance policies with:

- Extended or Guaranteed Replacement Cost coverage

- Cash-out options

- Pre-approved flexibility for upgrades or substitutions

- Loss payee waivers for lender issues

At your next renewal, ask your agent:

“What coverage options will give me more freedom during a claim?”

Summary: Can You Use Home Insurance Claim Money Differently?

| Category | Key Takeaways |

|---|---|

| 🧾 Claim Payment Structure | Most homeowners policies pay in two parts: ACV (initial payment) + Recoverable Depreciation (held back) |

| 🧩 Can You Use It Differently? | ✅ Yes, but you may lose the second payment if you don’t replace the exact item |

| 📑 Proof Required | Insurance companies usually ask for receipts, contractor invoices, photos, and final inspections |

| ⚠️ Risks | Changing the item may result in: |

- Loss of depreciation reimbursement

- Mortgage lender objections

- Possible non-renewal |

| 💬 Real-World Insight | Both Reddit comments and the Farmers v. Subscribers court ruling confirm: item-specific use matters |

| ⚖️ Legal Framing | Insurers have a fiduciary duty to manage funds in the subscriber’s best interest, not just pay out blindly |

| 📌 Helpful Coverage Options | These add-ons increase flexibility:

- Extended Replacement Cost

- Cash-Out Option

- Pre-approved Upgrade Clause

- Loss Payee Waiver |

| ✔️ Action Checklist | 1. Re-read your policy

- Ask your insurer in writing

- Save all documents

- Photograph damage and repairs

- Check with your mortgage lender first |

Final 3-Sentence Recap

- You can sometimes use your insurance payout differently, but you risk losing recoverable depreciation.

- Your insurer and lender may require strict documentation and adherence to the original claim scope.

- The best protection is asking questions early, documenting everything, and choosing flexible policy features.

I Got a $1,770 ER Bill One Year Later — What You Need to Know About Out-of-Network Charges

Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal…

Why Good Sam RV Insurance Is the Top Choice for RV Owners in America

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage,…

Can You Really Use Home Insurance Claim Money for Something Else?

Wondering if you can use your home insurance claim for a different repair? We break…

What to Do When an Unauthorized Driver Hits You in a Rental Car Accident

Got hit by an unauthorized driver in a rental car and left with unpaid bills?…

I Woke Up With No Memory, Vomiting, and Two Pairs of Underwear — What Happened to Me?

She woke up sick, confused, and with no memory — her clothes were changed, her…

When a Developer Demands You Move Your Mailbox: A Houseowner’s Stand Against Unfair Pressure

A developer told a rural houseowner to move their mailbox to make way for a…