Got hit by an unauthorized driver in a rental car and left with unpaid bills? Here’s how to understand your legal options and what it takes to sue.

- When a Rental Car Crash Isn’t So Simple

- Who Was Driving — and Why That Matters

- Can You Hold the Rental Contract Holder Responsible?

- What If the Driver Has No Insurance?

- Should You Sue? Weighing Cost vs Outcome

- Why Your Insurance May Not Help Much

- Why Your Insurance Stops Helping

- Extra Legal Tools You Might Overlook

- Lessons Learned: Don’t Let This Happen to You

- Key Takeaways

- Essential Insurance Coverage for This Situation

When a Rental Car Crash Isn’t So Simple

Most car accidents follow a frustrating but predictable pattern. Someone hits you, you exchange insurance information, file a police report, and then the insurance companies fight it out. Eventually, you get compensated — at least in theory.

But what happens when the person who hit you wasn’t even supposed to be driving the car?

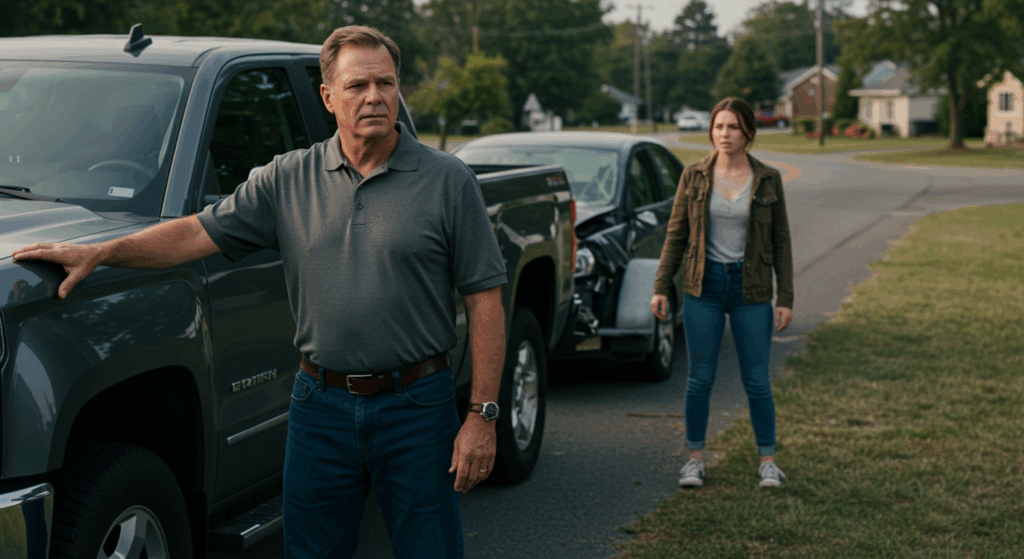

This isn’t just a hypothetical. It happened to a real driver in a small town in the U.S., who got rear-ended by someone in a rental car. Police and video evidence clearly showed the other driver was at fault. But the situation spiraled from there.

The woman behind the wheel wasn’t listed on the rental agreement. In fact, the car was rented by her stepfather, and she wasn’t authorized to drive it. She was also under 25 — a big red flag in rental policies. Worse, she fled the scene without giving her insurance details. She never even reported the crash to the rental company.

Now imagine being the victim in this situation. Your insurance company steps in and covers most of the costs, but you’re still left with thousands in deductibles, rental overages, and emotional stress. The responsible party disappears into silence. And no one seems to be coming to your aid.

This is what happens when a “normal” car accident turns into a legal maze. And if you’re not prepared, you could end up footing the bill for someone else’s recklessness.

Who Was Driving — and Why That Matters

In most car accidents, there’s no doubt about who was driving — and insurance companies don’t really care, as long as the driver was authorized. But with rental cars, that’s not always so simple.

Rental car agreements include a specific list of who is allowed to drive the vehicle. These “authorized drivers” are usually:

- The person who rented the vehicle

- A spouse or domestic partner

- Anyone explicitly listed on the rental form

Anyone else — including friends, siblings, or stepchildren — is typically considered an unauthorized driver.

Why does this matter? Because if the driver wasn’t authorized, the rental car company’s insurance and even the renter’s personal insurance may refuse to cover any damage. In legal terms, it’s like the car was stolen, even if the unauthorized driver is a relative.

In the Reddit case we’re analyzing, the woman who caused the accident wasn’t listed on the rental contract at all. She wasn’t covered by the rental company’s liability policy. And worse, she was under 25 — below the age most companies allow, even for authorized drivers.

When your accident involves an unauthorized driver, you’re not just fighting over whose fault it was. You’re fighting over whether insurance applies at all.

And that changes everything.

Can You Hold the Rental Contract Holder Responsible?

What if the person who rented the car wasn’t the one driving?

It’s a common mistake to assume that the person who rented the car is automatically responsible for everything. Legally, that’s not always true. But when a renter gives their car — knowingly or not — to an unauthorized driver, things can get messy fast.

In the case we’re examining, the woman who crashed the rental car wasn’t the person who signed the contract. Her stepfather was. And here’s the twist: he showed up at the crash site to pick her up, driving a brand-new pickup truck with a trailer. That raised a big question — did he knowingly let her use the rental?

If the answer is yes, he could be held partially or even fully responsible for the accident, even if he wasn’t driving.

When does a renter become liable for someone else’s actions?

Generally, if the renter gave permission — directly or implied — for someone to drive the car, they could be held responsible. This includes:

- Handing over the keys knowingly

- Leaving the keys out where the driver could reasonably take them

- Failing to supervise or prevent known misuse

If the renter denies giving permission, the court must determine whether it’s believable.

And this is where things get strategic.

The legal gray zone: “I didn’t let her drive.”

In civil cases, the burden of proof is lower than in criminal court. The standard is preponderance of evidence — meaning it just has to be more likely than not that he allowed her to drive.

So if a stepfather shows up to retrieve the car and doesn’t report it stolen? That looks a lot like silent permission.

As one commenter put it:

“If he didn’t give permission, why didn’t he call the police and report the car stolen?”

What If the Driver Has No Insurance?

You’re hit by a rental car, but there’s no insurance. Now what?

Let’s say someone crashes into your car. You learn later that the driver was in a rental car — but wasn’t authorized to drive it. Worse, they have no insurance of their own. The rental company denies liability because the driver wasn’t listed. The driver’s stepfather (the renter) says he didn’t give permission. Now you’re stuck.

This isn’t theoretical. This is exactly what happened in the Reddit case we’ve been discussing.

What are your options when no one’s insured?

You may still be covered by:

- Your own uninsured/underinsured motorist (UM/UIM) coverage

- Collision coverage on your auto policy

- Personal injury protection (PIP) or MedPay

These coverages don’t depend on the other driver having insurance. But — and it’s a big but — they don’t cover everything. Victims often still pay:

- Deductibles

- Rental car overages

- Out-of-network medical bills

- Emotional damages (not covered at all)

As one commenter put it:

“You may win the war — but still lose your wallet.”

Why won’t the rental company pay?

Rental companies only insure authorized drivers. If someone wasn’t listed on the agreement, it’s considered a breach of contract. In many states, this lets them legally deny all liability.

Even if they carry minimum state-required liability, they may refuse to pay until:

- The damage is proven to be their legal responsibility

- A lawsuit is filed and judgment obtained

So… who actually pays in the end?

- If the driver has no assets → You may never recover

- If the renter gave permission → You might sue them, but it’s hard to prove

- If the rental company had liability → It may take legal action to force payout

- If only your insurance pays → You’re stuck with out-of-pocket losses

⚠️ Still pay deductible & rental overage

Should You Sue? Weighing Cost vs Outcome

You’re out thousands — but is it worth suing?

After dealing with a damaged car, paperwork, and unresponsive parties, you’re left with the ultimate question:

Should I take them to court?

In many rental car accident cases involving unauthorized and uninsured drivers, victims are left with deductible payments, rental car overages, and other out-of-pocket expenses.

A lawsuit might seem like justice — but is it worth the time, stress, and cost?

Small Claims Court vs. Full Civil Lawsuit

Most accident-related lawsuits under $10,000 can go through Small Claims Court. You don’t need a lawyer, the fees are lower, and the timeline is faster.

| Court Type | Best For | Pros | Cons |

|---|---|---|---|

| Small Claims | $2K–$10K loss | Fast, cheap | No discovery, limited appeal |

| Civil Court | $10K+ or complex case | Full legal power | Expensive, time-consuming |

Even if you win, you still need to collect. If the person has no job or assets, your court victory might not mean anything.

“A judgment is just a piece of paper — unless the other party has money.”

Suing the renter vs the driver — or both?

You can name both the unauthorized driver and the rental contract holder (stepfather) in your lawsuit.

But keep in mind:

- The driver is clearly liable, but may have no assets

- The renter can deny permission, leaving you to prove otherwise

- The rental company won’t respond unless sued directly — and they’ll fight hard

As one user put it:

“If nothing else, make them explain themselves in front of a judge.”

When a lawsuit makes sense (and when it doesn’t)

| Suing Makes Sense When: | Suing May Not Be Worth It If: |

|---|---|

| You have strong evidence | The driver is untraceable |

| The renter has provable assets | No one has insurance or income |

| Emotional justice matters to you | You don’t have time for a fight |

| You want to pressure a settlement | You can’t afford court costs |

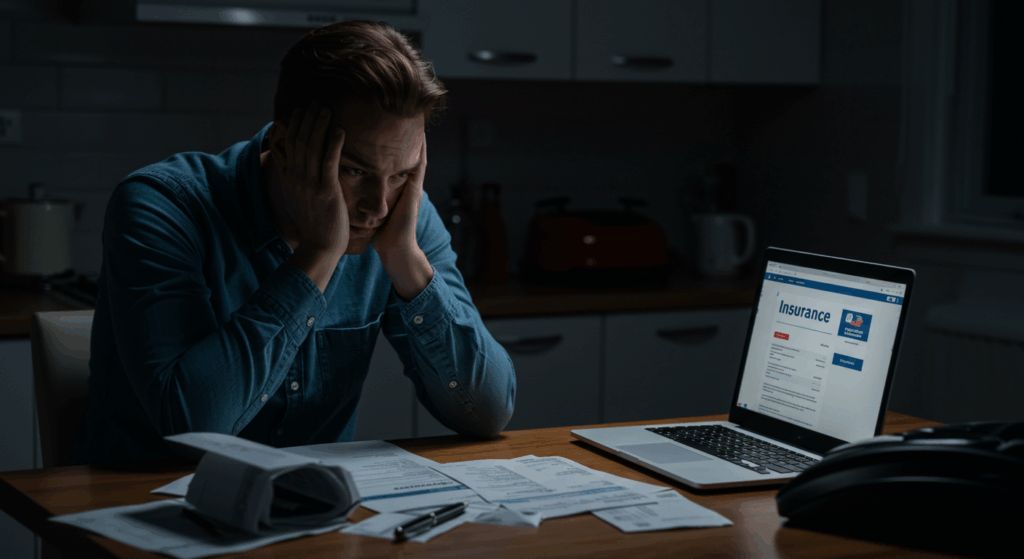

Why Your Insurance May Not Help Much

You paid for coverage — so why aren’t you fully covered?

It’s a painful truth: having car insurance doesn’t mean you’ll be made whole. Many accident victims are shocked when they realize how many expenses fall outside their policy, even if they did “everything right.”

Most standard policies only cover:

- Your car repair (minus deductible)

- Some medical costs (only within coverage limits)

- Rental car coverage (if purchased as add-on)

- Uninsured motorist claims (if you selected that option)

What they don’t cover:

- Deductible itself

- Rental car overages (e.g. if coverage only allows $30/day)

- Emotional stress, lost time, inconvenience

- Third-party damages not assigned to you

Why won’t your insurance go after them for you?

This is where subrogation comes in — your insurer pays you, then pursues the at-fault party to recover what they paid.

But here’s the catch:

- If the insurer thinks the case is weak or the defendant is broke, they may skip subrogation entirely.

- If they pursue it, they recover only what they paid, not your out-of-pocket losses.

So even if you “win,” you’re still out money unless you sue separately.

“Your insurance company doesn’t care about your deductible. You do.”

Insurance protects you — but only to a point

Let’s be honest. Insurance companies don’t make money paying out claims. Their goal is to:

- Limit payouts

- Shift liability to others

- Close files quickly

If your case falls in the “gray area” — unauthorized driver, rental vehicle, no clear liability — your insurer may simply decline to pursue further.

And that leaves you alone to fight.

Why Your Insurance Stops Helping

Only what they paid

You’re left with unpaid costs

But only if you act independently

Extra Legal Tools You Might Overlook

Reporting the accident to your state’s DMV

Many U.S. states require you to report any accident involving a rental car, injuries, or damages over a certain dollar threshold — typically $1,000 or $2,500.

If the unauthorized driver fails to report it, and you do, it can lead to:

- Suspension of their driver’s license

- Mandatory SR-22 insurance filing

- A formal record of the accident you can use in court

“Make sure you file the DMV accident report — even if no one else does.”

The power of police follow-up reports

If the original police report was incomplete, or if new evidence emerges later (like dashcam footage or the driver’s identity), you can request:

- An amended police report

- A supplementary witness statement

- A clarification of fault assignment

This can significantly strengthen your legal position and insurance claim.

Contingency attorneys: When you can’t afford to fight

If you can’t pay a lawyer upfront, look for personal injury attorneys who take contingency cases.

They only get paid if you win — usually around 30–40% of the payout.

Why this matters:

- They take on the burden of filing, negotiating, and suing

- Their presence can pressure renters, insurers, or companies into settling

- Some lawyers will even front court costs

These tactics are pressure, not guarantees

These legal tools aren’t magic bullets — they don’t guarantee payment.

But they can:

- Force the other side to take you seriously

- Trigger consequences like license suspension

- Add pressure toward a settlement or court resolution

Even without a payout, they give you leverage.

Legal Tools Outside of Court

Lessons Learned: Don’t Let This Happen to You

It’s not just about insurance — it’s about preparation

We assume insurance will protect us, but reality shows that insurance has limits — especially when the other driver isn’t even supposed to be driving.

“This experience taught me that insurance is not a safety net — it’s a negotiation tool.”

Here’s what I wish I’d done earlier:

- 📑 Added uninsured motorist coverage

- 🔍 Read every detail in my policy

- 📝 Kept printed copies of my claim history and photos

- 🚨 Called the police on the spot — and insisted they make a full report

When someone else drives — know the risks

Rental car companies may look the other way, but legally, only the listed driver is covered.

Letting a family member or friend drive your rental:

- Voids most rental agreements

- Can leave you on the hook for thousands

- Gives insurers an excuse to deny everything

“If they aren’t on the rental form — they’re not covered. Period.”

Don’t expect help unless you push

From insurance adjusters to rental companies, everyone is trying to limit liability.

If you don’t push for your rights:

- You may never get reimbursed

- Your documentation may disappear

- Deadlines may expire

Protect yourself:

- Follow up regularly

- Keep everything in writing

- Don’t hesitate to involve legal counsel early

Final Lessons and What to Do Differently

Key Takeaways

- A rental car crash occurred where the driver at fault was not listed on the rental agreement, making them uninsured.

- Although a police report and video evidence were secured, the at-fault party refused contact, fled the scene, and did not report the accident.

- The victim’s own insurance paid for most of the damage, but several thousand dollars in out-of-pocket expenses remain.

- Legal options like small claims court, DMV reporting, police report amendments, and contingency lawyers are available, but none guarantee recovery.

- The big lesson: Don’t blindly rely on insurance. Be prepared to document, report, and push back. Always confirm who is authorized to drive.

Essential Insurance Coverage for This Situation

| Insurance Type | Description | Why It Matters |

|---|---|---|

| Uninsured/Underinsured Motorist (UM/UIM) | Covers damages when the at-fault party has no or insufficient insurance | ✔️ Crucial for protecting yourself when others are uninsured |

| Collision Coverage | Pays for damage to your vehicle regardless of fault | ✔️ Helps cover repair costs in rental-related accidents |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages (varies by state) | ❓ Required in no-fault states |

| Legal Expense Insurance (optional) | Helps pay for attorney and court fees | ❗Useful for small claims or formal lawsuits |

| Rental Car Liability Insurance | Covers rental car use, even for additional drivers (if allowed) | 🚫 Not valid if the driver isn’t listed on the rental agreement |

I Got a $1,770 ER Bill One Year Later — What You Need to Know About Out-of-Network Charges

Emergency care might feel urgent, but your insurance might not agree. Here’s how to appeal…

Why Good Sam RV Insurance Is the Top Choice for RV Owners in America

Find out why thousands of RVers trust Good Sam for total loss replacement, full-timer coverage,…

Can You Really Use Home Insurance Claim Money for Something Else?

Wondering if you can use your home insurance claim for a different repair? We break…

What to Do When an Unauthorized Driver Hits You in a Rental Car Accident

Got hit by an unauthorized driver in a rental car and left with unpaid bills?…

I Woke Up With No Memory, Vomiting, and Two Pairs of Underwear — What Happened to Me?

She woke up sick, confused, and with no memory — her clothes were changed, her…

When a Developer Demands You Move Your Mailbox: A Houseowner’s Stand Against Unfair Pressure

A developer told a rural houseowner to move their mailbox to make way for a…